Forms…government forms. Most of us want to avoid filing these out at all costs. But any writer, like you, who wants to run a writing and publishing business needs to file with the government for a variety of reasons, and you want to know what forms to fill out as well as how and when to do so. Today, author and attorney Helen Sedwick (@HelenSedwick) offers advice on how to become “legit” in the government’s eyes by filing the correct forms. This post is the third in Helen’s series on the business side of writing and publishing.

In my earlier posts, I explained why operating as a business can save taxes and how to choose a company name. Today, I will walk through the process of handling the few governmental filings required for businesses. Many writers dread filling out government forms. It’s somewhere on their to-do lists well below dental appointments. So, I will try to make this process as painless as possible.

Federal Employer ID Number

I recommend that every writer who hopes to earn income from writing, no matter how little, obtain a Federal Employer Identification Number (EIN) for her writing business. An EIN is the business equivalent of a social security number. Once you have an EIN, you may use the EIN instead of your social security number for all your business accounts and dealings. It is added protection against identity theft.

- You may get an EIN even if your business is a sole proprietorship and never has employees.

- You may obtain an EIN whether you operate under a company name or your own name.

- It’s free and easy.

The only tricky part of getting an EIN is making sure you go directly to the IRS website to apply (www.irs.gov). Sham sites that look like the IRS site are popping up every day. They ask for your social security number, mother’s maiden name, birthday—all the tools for stealing your identity. Scary stuff. Plus, these sites charge hundreds of dollars to get you an EIN. Go directly to the IRS site, and it’s free.

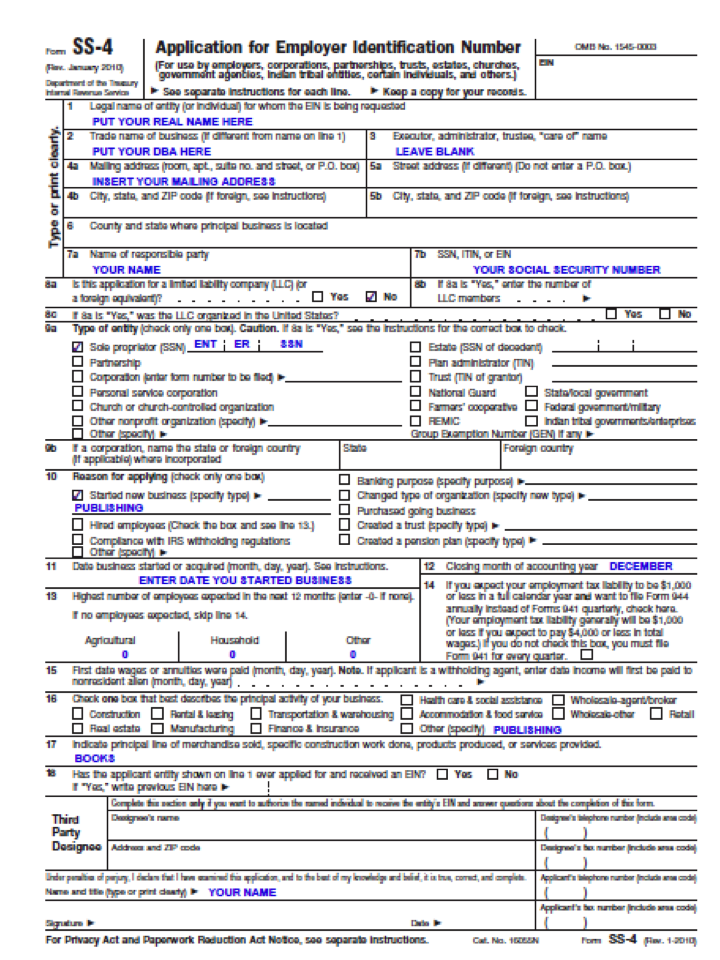

To apply for an EIN, you’ll be filling in the online equivalent of an SS4 form. Here’s a dummy of that form, so you know what information to have handy and how to fill in the blanks.

Your EIN will be issued while you wait online. Print out the application page and the page giving you the EIN. Save them with your business records. Write down your EIN someplace handy. You will need it often.

State EIN

In some states, you may have to obtain the state equivalent to the federal EIN. Check the requirements for your state. In California, you do not need a state EIN unless you are hiring employees.

Resale Certificate or Seller’s Permit

If you will be selling books either in person or through your website, you are required to obtain a Resale Certificate, sometimes called a Seller’s Permit, from your state if you live in a state that charges sales tax. A Resale Certificate is different from your EIN, ISBNs, business license number, or any other number. Welcome to the number-filled world of small business!

Most states issue Resale Certificates online and/or by mail for free. Some states require the certificate to be posted at the place of business, although no one is going to come into your home to inspect your bulletin board. If you don’t post the certificate, then keep the original certificate in a safe place.

The good news is once you provide a copy of your Resale Certificate or your certificate number to CreateSpace, IngramSpark, or other print-on-demand (POD) provider, you won’t have to pay sales tax on books you buy with the intent to resell.

The bad news is when you resell your books to customers, you will be obligated to pay sales tax to the state in which the transaction takes place, although you may charge it to your buyers. And you are required to fill out tax forms and pay the tax to your state. Calculating, collecting, and paying sales tax is a headache. For more details, see Sales Tax Basics for Writers.

Business Licenses

Many cities and counties require businesses to obtain a business license. You’ll have to do your own research on this item since each state, county, and even city has its own rules. In some places, you are required to get a license only if you have employees. Others ask about total sales. Generally, the larger the town or city, the more likely you will need a business license.

Do a web search for “business license” and the city, town, county, and state where your business is located. Often, a city or state website will have a section to help with this process. Check for links titled Doing Business, Starting a Business, or Business Portal.

Do a web search for “business license” and the city, town, county, and state where your business is located. Often, a city or state website will have a section to help with this process. Check for links titled Doing Business, Starting a Business, or Business Portal.

For example, I researched the business licenses an indie author would need if she worked from home in San Francisco. I learned that every person engaging in business within the city must register with the Office of the Treasurer and Tax Collector within 15 days after commencing the business and must renew the registration and pay a new fee every year. The fee depends on gross revenues and number of employees, but the minimum annual fee is $90. The writer must also register with the Assessor’s Office, which imposes a personal property tax on the writer’s business property, such as computers and printers.

That’s it for governmental filings, at least until tax time. In my next post, I’ll cover some of the tax basics of running a small business.

If you want to jump ahead, or would like more details, then I recommend you purchase Publishing Business in a Box, a kit I wrote for Author Toolkits. Not only does it break down business set-up into easy-to-follow steps, but the kit also includes various sample contracts such as a freelancer agreement, interviewee release, and non-disclosure agreement.

About the Author

Helen Sedwick is an author and California attorney with thirty years of experience representing businesses and entrepreneurs. Publisher’s Weekly lists her Self-Publisher’s Legal Handbook as one of the top five resource books for independent authors. Her blog coaches writers on everything from saving on taxes to avoiding scams. For more information about Helen, check out her website at helensedwick.com.

Helen Sedwick is an author and California attorney with thirty years of experience representing businesses and entrepreneurs. Publisher’s Weekly lists her Self-Publisher’s Legal Handbook as one of the top five resource books for independent authors. Her blog coaches writers on everything from saving on taxes to avoiding scams. For more information about Helen, check out her website at helensedwick.com.

Disclaimer: Helen Sedwick is an attorney licensed to practice in California only. This information is general in nature and should not be used as a substitute for the advice of an attorney authorized to practice in your jurisdiction.

Photo courtesy of Vitaliy Vodolazskyy / 123RF.com.